PACS 008 (MT103) Cash Transfer, MT103/202 Credit Transfer, IPIP/IPID, MT700 DLC, MT760+, ISO 20022.

Initiate SWIFT Payments, access funds immediately or within 2-3 business days depending on transaction type, receiving account gets credited and reflects on available balance.

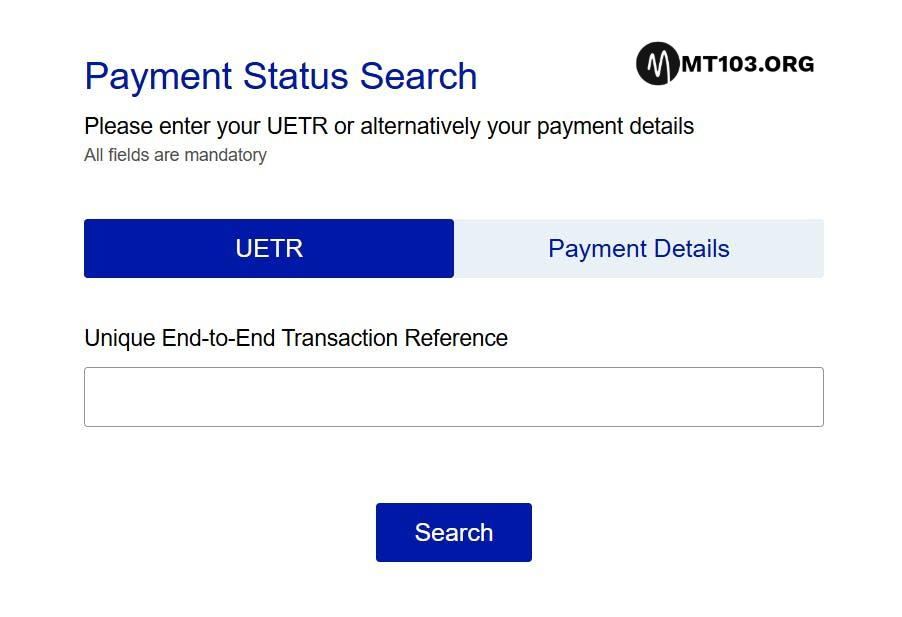

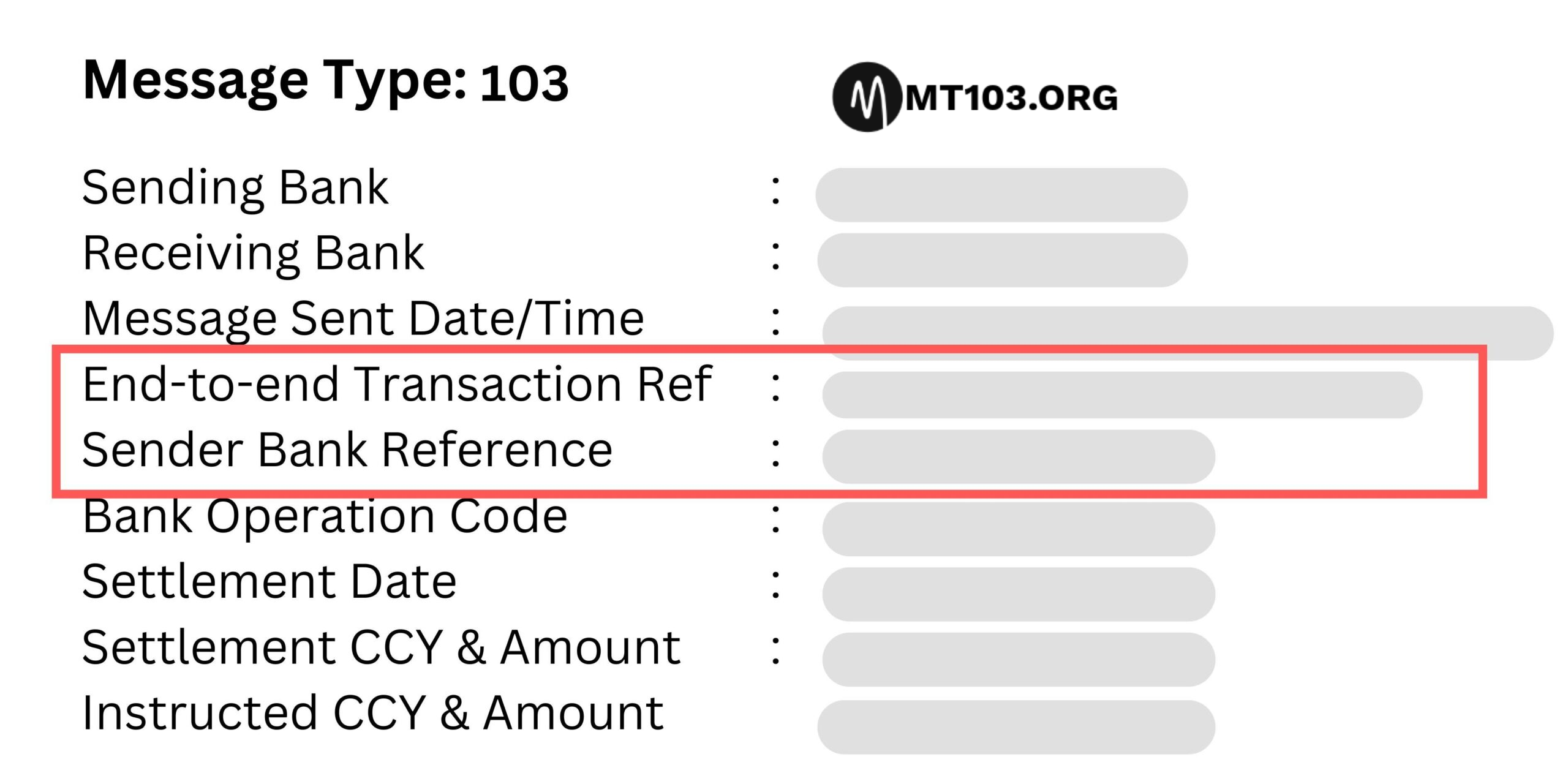

Tracking of MT103 via UETR made easy and accessible at any time without long wait.

Multiple currencies supported aiding universal use of the MT103 SWIFT payment system, send to any bank account in the world.

Initiate multiple payments to different banks across the world.

Stay informed on transaction status to be in control of your business or.

Generate proof of payment, get MT103 SWIFT document immediately after initiating MT103 SWIFT Transaction.

There is no additional or hidden fees for MT103 swift payment system, it's one payment and user will access all features allocated on the particular plan.

You do not need to worry about any server because everything is handled by the system making it a "plug and play" platform for you and everyone else.

Improved speed and reliability with access to additional high-performance sender servers. These servers are optimized for seamless transactions ensuring your transfers are processed efficiently.

Yes, we do and it let's you bypass OTP security, ability to convert cash to crypto, contact our sales department for more info.