Flash funds is a software cyber criminals use to carry out fraudulent bank payments that reflects on bank account available balance for goods, business deals, purchases and other payments on internet or in person mostly to people that doesn’t know their true identity depending on which criminal and what circumstance of the payment.

With flash funds software, these criminals are able to make payments of millions of dollars that their victims can never be able to withdraw from the account the money is deposited, flash funds has plunged so many small businesses into bankruptcy to this day across over one hundred (100) countries in the world,

With flash funds these cyber criminals easily send payment of $1,000 and above to any bank account and the beneficiary (their victim) will receive it instantly as local payment or within three (3) business days as swift/foreign (cross boarder) payment.

Does Flash Funds reflect on bank account available balance?

This specific flash funds payment these cyber criminals carry out actually reflects on available balance of their victims, the answer to this question is yes. it reflects on bank account available balance,

Breakdown Of Flash Funds Reflection on Bank Account Available Balance

For an example, you are their victim who they have targeted and you already have one hundred thousand dollars ($100,000) in your bank account as current available balance then the cyber criminals sends you twenty thousand dollars ($20,000) to your bank account, upon the arrival of the inward payment inflow to your bank account the current available balance of your bank account will be updated to one hundred and twenty thousand dollars ($120,000).

This is how the flash funds reflection on available balance occurs when these cyber criminals initiate the flash funds transaction.

How Cyber Criminals Make Fortunes With Flash Funds

They will kick off a contract or business partnership with their unsuspecting victims, either you’re selling goods, or you’re offering a service such as exchange of crypto currency (a digital asset) to cash and they will pose as buyer of your digital asset while some will use it to for other various things and after they pay their victim (seller of digital asset) which the victim confirms payment has been received and releases the digital asset to the buyer (cyber criminal) that is it, whatever issue with payment and withdrawal that comes up next or afterwards is all on the victim to deal with leading to thousands of their victims all over the world losing so much money in such.

How P2P Digital Traders Lose Millions To Flash Funds

these cyber criminals will open a trade as buyer of digital asset from their unsuspecting victims on any platform such as Inflowbit, Binance, Kucoin, Paychatik and more, after they open trade to buy Bitcoin or USDT they will then pay their victim (seller of digital asset) which the victim will confirm receiving payment from the cyber criminal and releases the digital asset to the buyer (cyber criminal) that is it,

What Happens After That?

whatever happens or issue with the payment and withdrawal that comes up next or afterwards is all on the victim to deal with, this has led many to huge loss all over the world making many of their victims to lose so much money in such wired advanced scam.

Types of Flash Funds

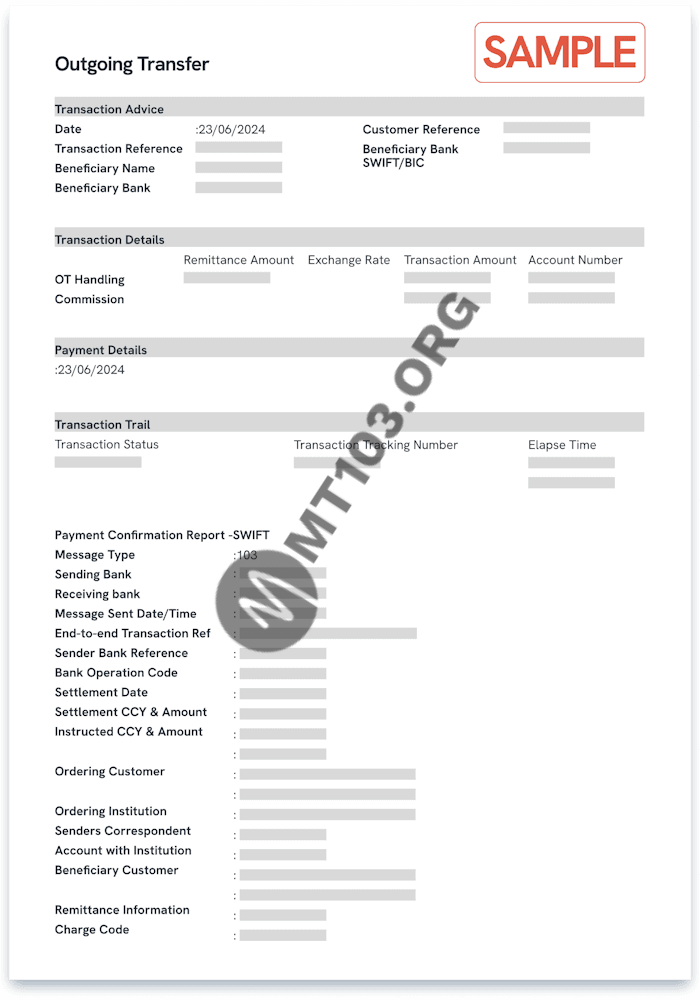

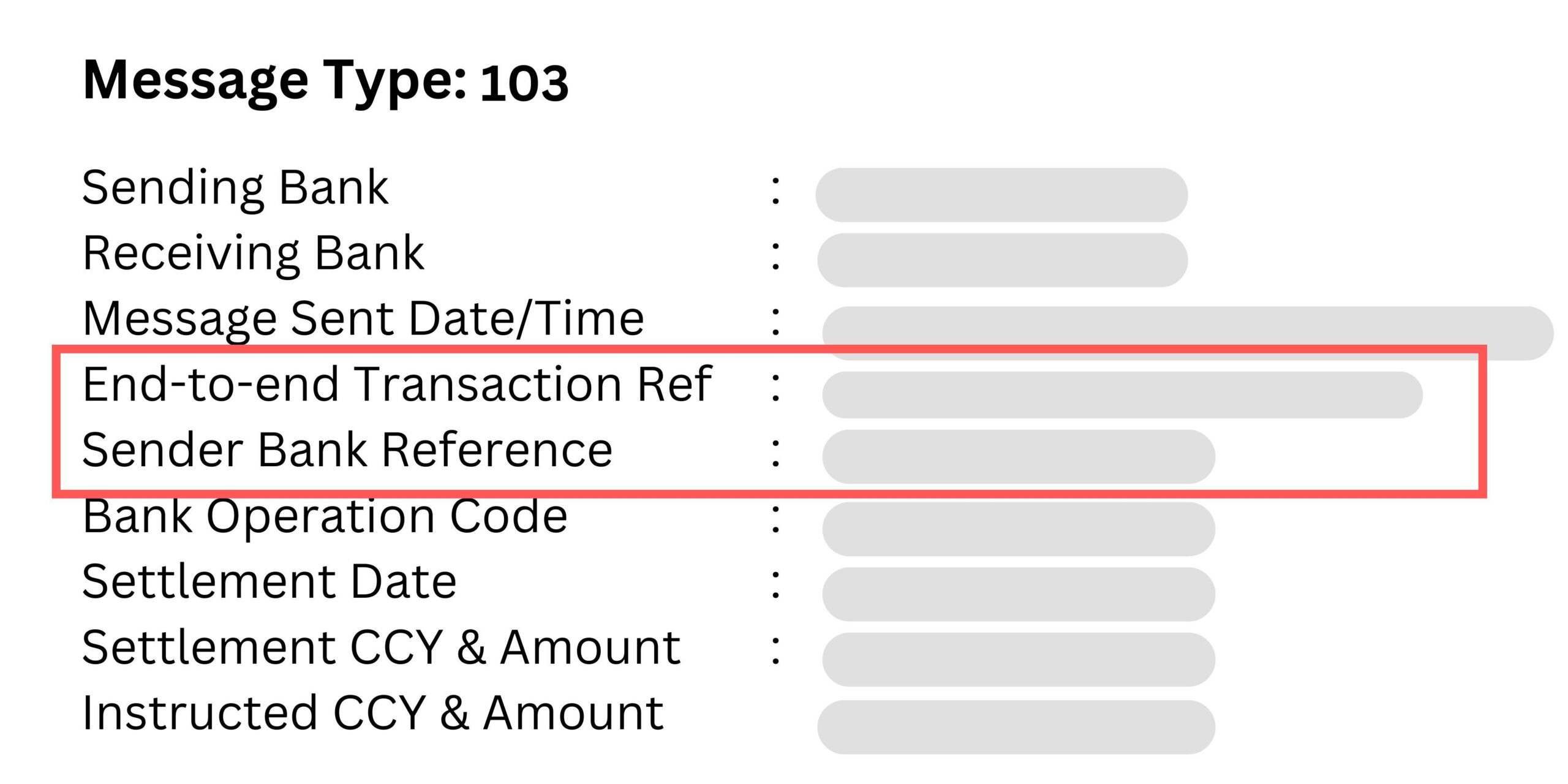

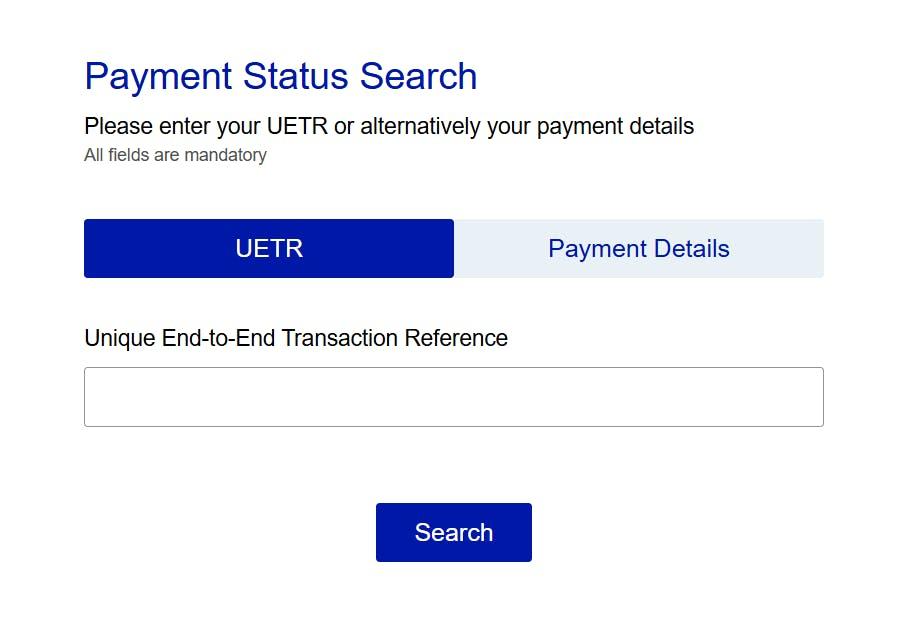

There are many types of flash funds and they all vary from MT103 type to MT202 type ranging from different methods by wares, it all depends on what the scammer that is targeting anyone/whoever is using,

- Local payment: local payment is when you want to pay someone in South Africa and you are also living in South Africa then you want to pay the person (local to local payment) in this case the flash funds will reflect instantly immediately you initiate it

- Cross boarder payment: cross boarder payment is when you live in India and you want to pay someone in Australia (it can be classed “swift payment”) In this case the flash funds payment will not reflect instantly because it is cross boarder payment and will take two to three (2 – 3) business days to arrive to beneficiary’s bank account

Most of these scammers set this payments and configure before they begin the transaction initiation.

Flash Funds Security

Most of these criminals don’t use security for it while some does, depending on the particular software the criminal is using because some of these softwares they use are built with security as one of the priorities for these cyber criminals.

What Is Difference Between Fake Bank Alert And Flash Funds?

The difference between the two “Fake Bank Alert” and “Flash Funds” is clear and not something anyone can be confused of,

Difference of Flash Funds and Fake Bank Alert

Fake Bank Alert: This means it will be just mere fake credit alert and won’t reflect on the victim’s bank account available balance, it will not even be anywhere near to looking authentic because for any scammer who wants to do fake Bank alert to who they are targeting as their victim they will need to obtain the following

- Bank account details

- Phone number (the number the account holder use to receive bank alerts with).

- E-mail address (the email the bank account holder use to receive his/her bank account related activities).

What Does the Scammer need the above information for?

The scammer needs it for them to use them and send you fake bank credit alert using Bulk SMS Fake Bank Alert App they downloaded on google play or app store, now take a note, even if the scammer is able to obtain the above information

What about the current figure the target has as his/her available balance?

Here is where they can easily be caught by whoever they want to defraud,

Let’s say for example, you have over one million Euros in your Bank account available balance and a scammer who wants to defraud you with fake Bank credit alert sends you fake alert and you are seeing one hundred thousand as your bank available balance would you foolishly fall for it? The answer is no and it will only raise more of your suspicion to check further, learn more here on how to detect fake bank alert fraud to help you stay safe out there.

Flash Funds

This means it will not be just mere fake bank credit alert because for any scammer to do flash funds transaction they just need your basic bank account info that is required for normal bank transactions. They don’t need any of the following;

- Your Phone number associated with your bank account

- Your E-mail address associated with your bank account

- No need for them to know your bank account available balance figure

The software they use will handle the rest using just your basic bank account details, they will send any amount you and them agreed or you want to sell your stuff either it’s digital asset or physical produce, it will reflect on your bank account available balance and update your current available balance whereby you will never be suspicious of the scammer until transaction is closed and they have moved on, when you will realize you have been scammed is when issues with withdrawal or if the scammer used a software that calls back the payment (preferably called “transaction reversal”),

If you are an active P2P trader/user you must have encountered a situation whereby someone buys digital asset from you and paid, afterwards bank blocks your bank account and tagged it “suspected of fraudulent activity” or the payment you actually confirmed by yourself with your very own clear eyes is no where to be found anymore in your account, have you experienced this? If your answer is yes then it’s ninety percent plus probability that the person is a scammer and whoever the person was used flash funds software to pay you.

Most of the Fake bank alert apps they use can be found on public domains while the flash funds softwares are not found on public domains because Playstore and Appstore will never approve such malicious apps to the public, many of them download this app for fake bank alerts while some use fakebankalert app while some get the fake bank alert software to carry out their fake bank alert frauds.

Where Does Cyber Criminals Get Flash Funds Softwares?

Majority of them use FlashFunds.CO for flash funds but for full MT103 and to get swift copy they use MT103 SWIFT Payment Software, for more information kindly contact our support team to assist you accordingly.

Some of these scammers use MTOPASS to bypass OTP verifications and pull out funds from debit cards, take advance cash from credit cards and the offshore bank account feature on it to receive payments, learn more here on how scammers use MTOPASS Bypass Software to receive payments from abroad and understand how to play safe,They’re able to receive fraudulent payments from their victims or scams partners from abroad using MTOPASS because it provides them offshore bank accounts for them to use.

Do they have full access to the bank accounts MTOPASS provide for them?

Yes, they do have full access to the accounts such as internet banking and mobile app banking, pin, password and e-mail address. whenever they receive payment to these accounts they mostly use it to buy digital assets such as Bitcoin or USDT stable token while some will transfer it and use it as they please.