The steps to obtain an mt103 document are outlined on this article including how to do mt103 swift payment,

To perform an MT103 Swift Payment, you must first initiate an international payment through your bank or a financial institution that uses the SWIFT network, as this process automatically generates the MT103 message. After the payment is made, you request the MT103 document from your bank, as it is typically not provided unless requested. The process and cost for obtaining the document vary by institution, with some charging a fee while others offer it for free.

Steps to Obtain an MT103 Document

- Initiate a SWIFT Payment: Make an international transfer through your bank or a fintech company that processes SWIFT payments. The MT103 is generated automatically in the banking system once the payment is initiated.

- Request the MT103: Contact your bank or financial institution to request the MT103 document. This can often be done through their online banking service or by contacting customer support.

- Provide Details: You may need to provide details such as the date of the transaction, sender’s reference number, and other transaction-specific information.

- Receive the Document: Once requested, your bank will retrieve and provide the MT103 document, though this can take several business days.

Key Information on MT103 Documents

Purpose: The MT103 is a standardized SWIFT message that serves as confirmation of a payment made from your bank and contains detailed information about the transaction.

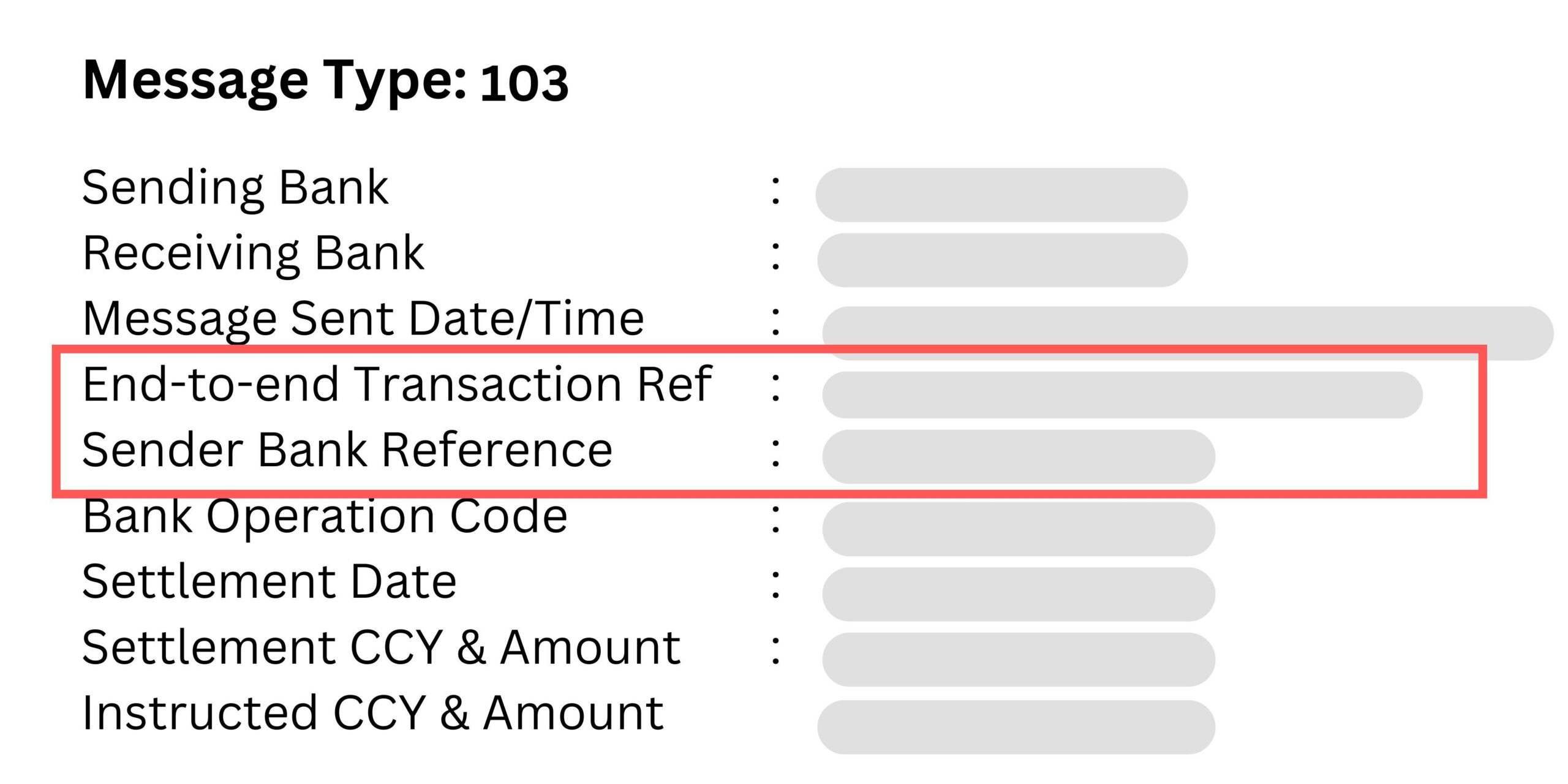

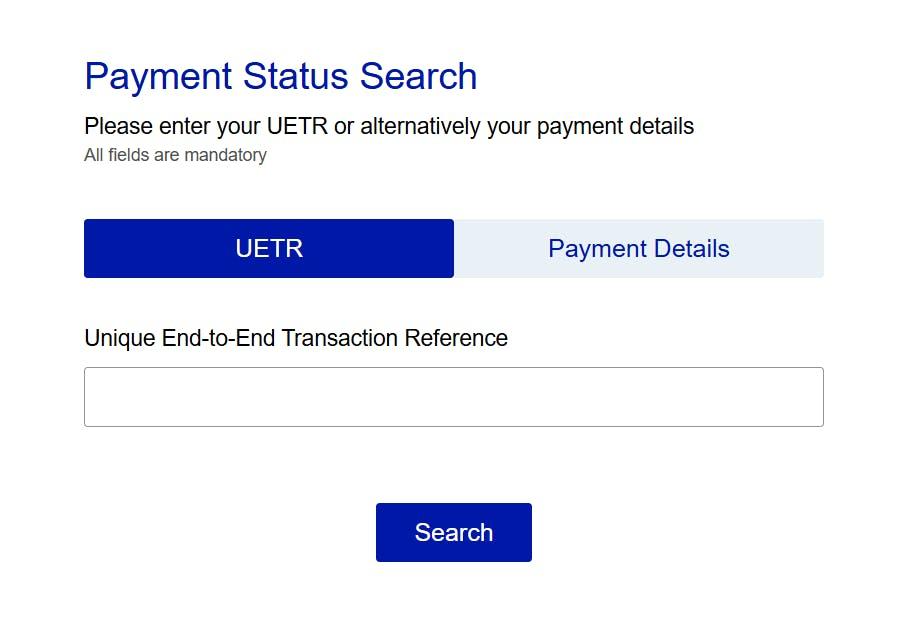

Tracking: The MT103 contains a unique identifier called the UETR (Universal End-to-End Transaction Reference) code, which helps in tracing the payment throughout the entire chain of banks involved.

When To Request: You might request an MT103 if your funds are delayed, if you need to review the transfer details, or for compliance purposes.

Take A Look At The Following Video

How Does MT103 Work?

When you initiate an international transaction, such as a telegraphic transfer or wire transfer, the software will prepare an MT103 document that includes all necessary payment details. These details include, but are not limited to:

- Your name

- Your recipient’s name

- Address

- Amount

- Currency

- SWIFT/BIC code.

The MT103 payment system securely sends this document through the SWIFT network, the dedicated messaging platform of it for financial institutions.

The beneficiary’s bank receives the MT103, verifies the information, and upon confirmation, credits the recipient’s account with the transferred funds, deducting fees as applicable. This is why you need the MT103 SWIFT payment software to personally use it for your benefit.