If you want to do MT103 swift payment with GPI automatic, MT202, MT700, MT760, MT799, MT199 and more. Cash/credit transfer, IPIP, IPID, DLC and custom CIS then you must need the MT103 Swift software;

With MT103 Swift Payment Software you can do the following types of payments:

- Local Payment (NIP/INTER-BANK/NATIONAL): local payment is when you want to pay someone in Russia and you are also living in Russia then you want to pay the person (local bank transfer), in this case the payment will arrive instantly.

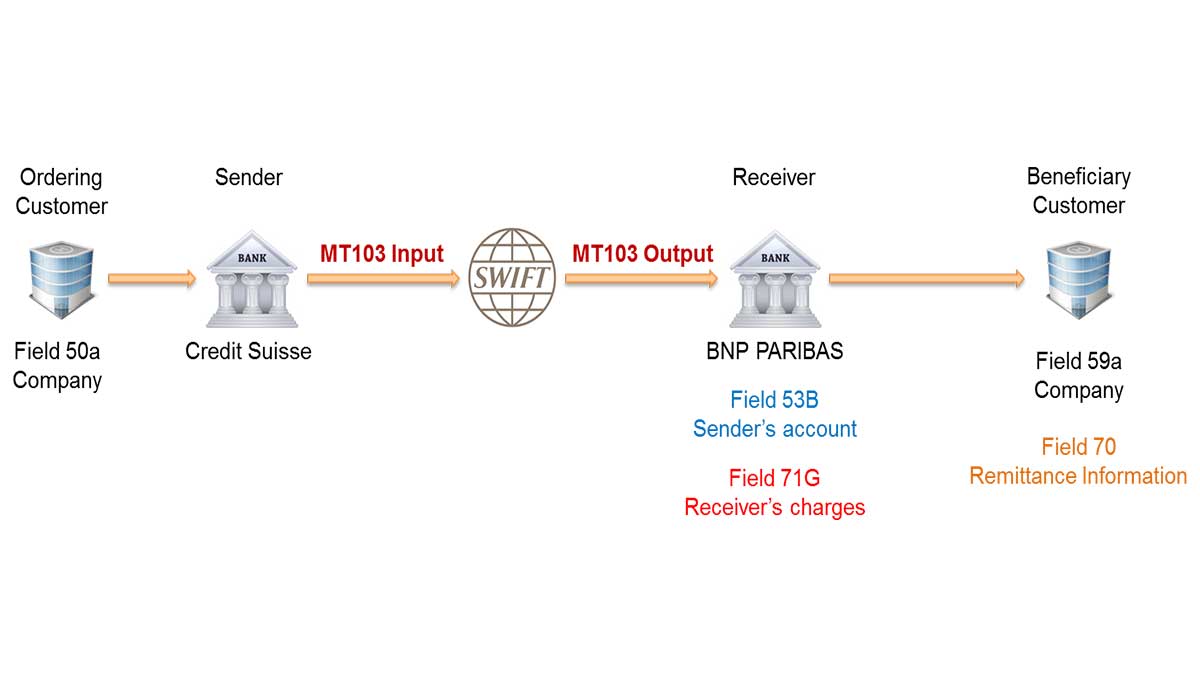

- Cross Boarder Payment: cross boarder payment is when you live for example, in India or any other country in the world and you want to pay someone in Australia (it can be tagged “swift payment”), in this case the MT103 cash or credit transfer will not arrive or reflect instantly on receiver’s bank account available balance. It will take two to three (2-3) business days to arrive into beneficiary’s bank account available balance.

Most of these scammers set this payments, configure it before they begin the transaction initiation using MT103 Swift Software.

What is MT103 Swift Payment System Used For?

Mainly, it’s used for mt103 swift, the key features of it are listed on first paragraph, cyber criminals misuse it as well for flash payments if the flash funds option is enabled.

Cyber criminals use this software for flash funds payments to finalise business deals, purchase of goods (digital assets inclusive such as bitcoin or usdt tokens on P2P platforms) learn more here.

Most of these criminals operate in person as well with people whom don’t know them or their real identity and disappear, majority of these criminals use thi mt103 software for P2P payments on crypto exchanges, they open an order for usdt or bitcoin and pay with it.

MT103 Swift Payment

With the flash funds option enabled on the mt103 software they are able to make payments of millions for digital assets, this has been a weapon for these cyber criminals against businesses and individuals which has plunged many individuals into bankruptcy as a result of this.

How Cybercriminals Commit Bank Fraud Using MT103 Swift Payment System

They can easily send $1,000 and above to any bank account in the world and the beneficiary (their victim) will receive it instantly as local payment or within three (3) business days as swift/foreign wire transfer (cross boarder) payment.

Does The Flash Funds Reflect On Bank Account Available Balance?

This specific flash funds payment or MT103 swift payment with flash enabled that cybercriminals use to make money off P2P traders or business/companies actually reflects on bank account available balance, the answer to this question is (YES).

Breakdown Of Flash Funds Reflection On Bank Account Available Balance

For example, you are the victim that is targeted and you already have one hundred thousand dollars ($100,000) in your bank account as current available balance then the cyber criminal sends you twenty thousand dollars ($20,000) to your bank account, upon the arrival of the inward payment (inflow), to your bank account, the current available balance of your bank account will be updated to one hundred and twenty thousand dollars ($120,000).

This is how the flash funds into bank account available balance works, it is how the reflection of the flash funds occurs when cyber criminals initiate the flash funds transaction.

How Cybercriminals Buy Crypto With MT103 Flash Funds Payment

The criminal (buyer) will appear as buyer of your digital asset while some will use it for various things and after they pay their victim (seller) of digital assets, when the victim (seller) confirms payment has been received amd releases the digital asset to the buyer (the cyber criminal) that’s it.

Whatever the issue with payment involving bank that comes up afterwards is all on the victim to deal with, this has led thousands of P2P traders around the world to huge loss.

How P2P Crypto Traders Lose Millions To Flash Funds Scam

A cyber criminal will download a crypto exchange app, most of them use Binance, Inflowbit, Kucoin, Kraken or Bitget and more. After they downloaded this app they will buy verified crypto exchange account and they will login with the info and open trade to buy crypto in the P2P section, any victim that comes forward to sell to them, they will flash their account with the exact amount generated on the P2P platform for the order, the victim will confirm payment and release the digital asset to the scammer.

The MT103 Flash Payment will fail after the designated time of hibernation, this will trigger bank’s security system to flag the customer’s account as fraud, the bank will then go ahead to make decision which will lead to the victim losing their digital asset sold and their account closed for fraud;

Have it on mind there are two types of Flash Funds and the following are the breakdown.

Two (2) Types Of Flash Funds

There are two types of flash funds and they vary just like there are different types of swift messaging ranging from 103 to 202 types and more, it depends on what is being targeted or scammer’s needs,

How Many Types Of Flash Funds Exist?

Only two types of flash funds exist, Fake Bank Alert that is commonly done by text and phone number and Flash Payment that us done with MT103 Swift Payment System Flash Enabled.

What’s The Difference Between Flash Funds And Fake Bank Alert?

The difference between Fake Bank Alert and Flash Funds is clear, it is not something anyone can be confused of.

Break Down Of Flash Funds And Fake Bank Alert Difference

Fake Bank Alert: this means, it will be just mere fake credit alert and it won’t reflect on bank account available balance, it will not be anywhere near authentic enough to be convincing because for any scammer who wants to do fake bank alert to someone they are targeting as their victim, they will need to obtain the following informations;

- Bank account details

- Phone number (the correct one linked to the receiver’s bank account which the receiver use to receive bank alerts)

- Email address (the correct email linked to receiver’s bank account)

What Does The Scammer Need Above Information For?

The scammer will need the above informations to use them and send the target the fake bank credit alert using fake bank alert platform, now take note;

Even if the scammer is able to obtain the above details, what about the current figure that is in the target’s bank account as available balance? That’s where they will easily be caught and mission will fail instantly.

In a clear explanation, you have one million pounds sterling (£1,000,000) in your bank account available balance and a scammer that wants to defraud you with fake bank alert sends you fake alert and you are seeing one hundred thousand as your bank available balance would you foolishly fall for such cheap scam? Ofcourse you will not,

It will raise suspicion that will lead to thorough further check because the numbers don’t add up, learn more on how to detect fake bank alert here and stay informed.

MT103 Swift Payment System Flash Enabled

This means, it is not mere fake bank alert because for any scammer to do flash funds transaction they will need just the receiver’s basic bank details that is required for normal bank transfers (to receive payment).

Kindly take note, they don’t need any of the following details!

- Receiver’s phone number

- Receiver’s email address

- Knowledge of receiver’s current balance

MT103 Swift Payment System With Flash Enabled will handle the rest, just receiver’s bank account details for receiving of payment is required, the cyber criminal will send exact amount agreed on wether is physical goods purchase or digital asset such as cryptocurrency, the payment will reflect on receiver’s bank account available balance and it will be updated to new balance,

There will be no suspicion until business or transaction with the party is closed and they moved on, the victim will face bank problems for fraudulent activity accusation.

The payment will be flagged and deemed suspicious and inauthentic transaction, some banks may tag it “Failed” then go on to add the customer on watch list,

If you are an active P2P trader reading this article you must have experienced this before, in some cases receiving fraudulent money, you must have encountered this problem whereby your bank blocked your account for fraudulent activity or the payment you confirmed is nowhere to be found after you have released digital asset to the buyer and even if you report them to the exchange they can’t be traced because they withdraw the assets immediately after you released them and they will abandon that account, buy another one and start again.

How MT103 Swift Flash Works

Mt103 flash works by establishing hybernated prepayment in an encryption flow between receiver’s banking system and the MT swift (MFFS often use the JOIPsc or SVVER/PYTT protocols). All outflows from the system locks in a command for payment authenticity checking initiation to commence after a designated time frame.

Does MT103 Swift Flash Require VPN?

No VPN is required from the user of the software, all activities on the software are encrypted. The system automatically provides different IP every minute and points to different locations in the world that even if cracked you can’t be traced, this is to conceal in event of any attack to protect users.

How To Get MT103 Swift Payment System

Any Additional Costs After Purchasing The MT103 Swift Payment Software?

No, there is no additional cost, it’s one payment and full access is granted that will last for 12 months, for further inquiry kindly hit the contact button below and talk to our support.